Many homeowners have fallen behind on their mortgage and could soon be on the path to foreclosure without permanent help. This gives you more time to repay your loan and reduces the amount you must pay every month.

The Benefits And Drawbacks Of A Loan Modification Realty Warehouse

The Benefits And Drawbacks Of A Loan Modification Realty Warehouse

Perfect and easy for modification and repair.

Flex modification program pros and cons. If this sounds like your situation you may be eligible to modify your mortgage. Some of the things a modification may adjust include. Everyone is looking for the perfect training split that will completely revolutionize their gains and bring about the best results.

List of the Pros of the Home Affordable Modification Program. The Fannie Mae Flex Modification program that replaced HAMP Home Affordable Modification Program allows you to reach an agreement with your lender and change the terms of your original mortgage. The FHA offers a variety of modification programs for eligible borrowers.

Borrowers with loans owned or guaranteed by Fannie Mae. For borrowers who. Bad for off-road racing.

Simple mechanism and better flex off-road. This program which replaces the now-expired Home Affordable Modification Program HAMP program is supposed to reduce an eligible borrowers mortgage payment by about 20. While the Flex Modification leverages the previously available Freddie Mac Standard and Streamlined Modifications a few significant changes from the Standard Modification include.

The program helped to keep families in their homes. It involves reducing or suspending your monthly payments for a certain period up to. Designed for carrying heavy loads.

For each individual the results will vary but realistically theres no wrong way to split your training. Does not have good handling. The Flex Modification can be applied to all mortgage loan delinquencies as well as to mortgage loans that are determined to be in imminent default in accordance with Fannie Mae and Freddie Macs Servicing Guides.

If you use a federal program it will not affect your credit. If youre having trouble making your monthly payments your lender may modify your loan and extend your term. Not comfortable compared to IFS setups.

It involves adjusting the loan terms for borrowers with mortgages that are at least one year old missed payments or facing foreclosure. If missed payments are added to the end of the loan it will take a few more months to pay off the debt. Taking a look at the pros and cons of mortgage modification can help you decide whether this is really the right path for you.

Pros and Cons of Solid Axle vs IFS Solid Front Axles Pros. The Flex Modification combines features of the Home Affordable Mortgage Program HAMP Standard Modification and Streamlined Modification. The Flex Modification program helps borrowers who have a Fannie Mae- or Freddie Mac-owned loan.

Solid Front Axles Cons. The pros and cons of push pull legs. Cons Homeowners will have to make pay more in interest.

The housing-to-income ratio component for borrowers less than 90 days delinquent has changed from less than or equal to 55 percent with a 10 percent floor to less than or equal to 40 percent. To qualify you may have to be ineligible to refinance your existing mortgage face long-term hardship andor be behind or likely to fall behind on your mortgage. When the subprime mortgage crisis hit many households found themselves struggling with high mortgage payments few job opportunities and a.

Most training splits are designed based on the individuals ability. Lowers your mortgage payment by as much as 20 with an adjustment of your interest rate loan duration or forbearance of a portion of your unpaid principal balance Adds the past due amount to the unpaid loan balance and recalculates your monthly payments over the new loan term so you wont have to pay the past due amount upfront. Pros This option provides short-term relief from financial hardships that will resolve quickly.

Pros Of Loan Modification. Fannie Mae and Freddie Mac offer a program called Flex Modification. Struggling FHA loan borrowers may also be eligible for government relief programs such as loan forbearance.

The Pros of a Loan Modification. To qualify you may have to be ineligible to refinance your existing mortgage face long-term hardship andor be behind or likely to fall behind on your mortgage payments in the near future. Options include the Fannie Mae Flex Modification which replaces the Home Affordable Modification Program HAMP that ended in December 2016.

The Freddie Mac Flex Modification Flex Modification provides eligible borrowers who are 60 days or more delinquent and the property is a primary residence second. In some cases a lower payment could help you get through a rough patch and avoid foreclosure. Pros of Loan Modification If you are behind on payments and the foreclosure process already started the modification process might put the brakes on the foreclosure and encourage the lender to move forward.

You can only get a loan modification through your current lender because they must consent to the terms. Servicers are encouraged to implement the Flex Modification. Robust and can take a beating.

There are several benefits to a loan modification. The Fannie Mae Flex Modification program that replaced HAMP Home Affordable Modification Program allows you to reach an agreement with your lender and change the terms of your original mortgage.

Pdf Pros And Cons Of Using Different Numerical Techniques For Transmission Loss Evaluation On An Automotive Muffler

Pdf Pros And Cons Of Using Different Numerical Techniques For Transmission Loss Evaluation On An Automotive Muffler

The Pros And Cons Of Loan Modification Hfh

The Pros And Cons Of Loan Modification Hfh

The Pros And Cons Of Loan Modification Hfh

The Pros And Cons Of Loan Modification Hfh

Pros And Cons Of A Flexible Work Schedule

Pros And Cons Of A Flexible Work Schedule

/advantages-and-disadvantages-of-flexible-work-schedules-1917964-FINAL-5b8811f846e0fb00501451e4.png) Pros And Cons Of A Flexible Work Schedule

Pros And Cons Of A Flexible Work Schedule

Loan Modification Vs Refinance How To Decide Credible

Loan Modification Vs Refinance How To Decide Credible

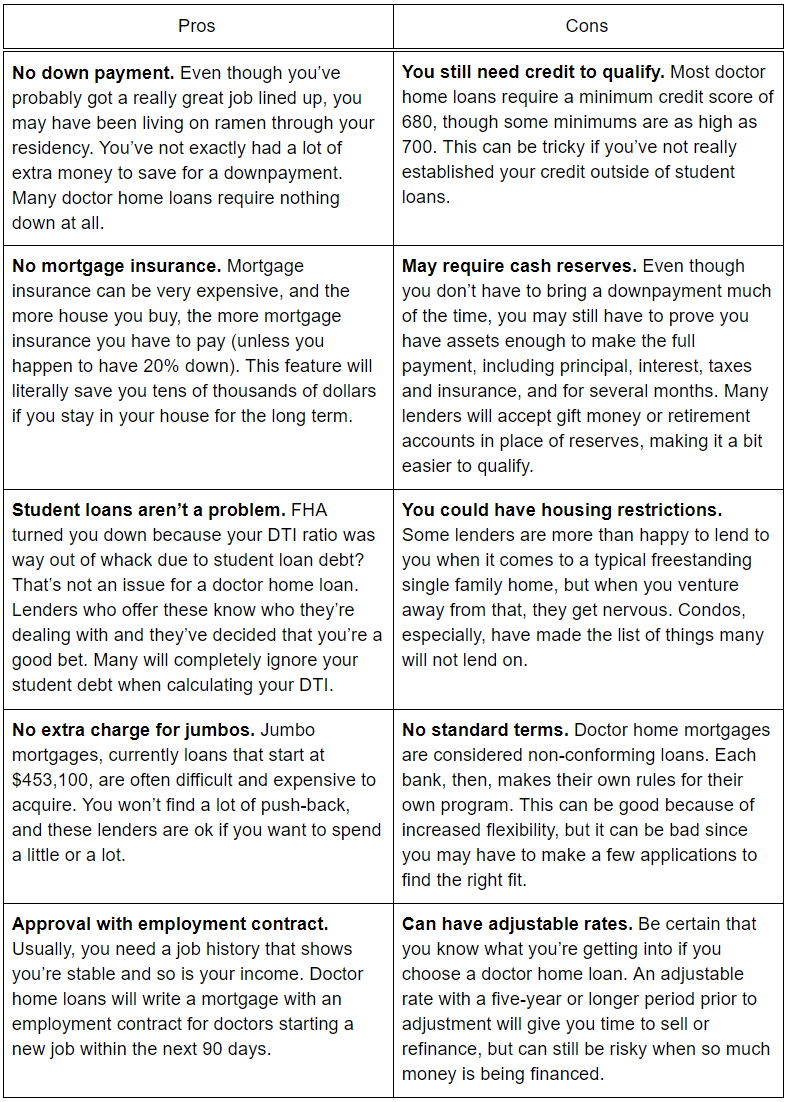

Everything You Need To Know About Doctor Home Loans Home Loans

Everything You Need To Know About Doctor Home Loans Home Loans

Pros And Cons Of Different Options For An Independent Permanent Iwt Download Table

Pros And Cons Of Different Options For An Independent Permanent Iwt Download Table

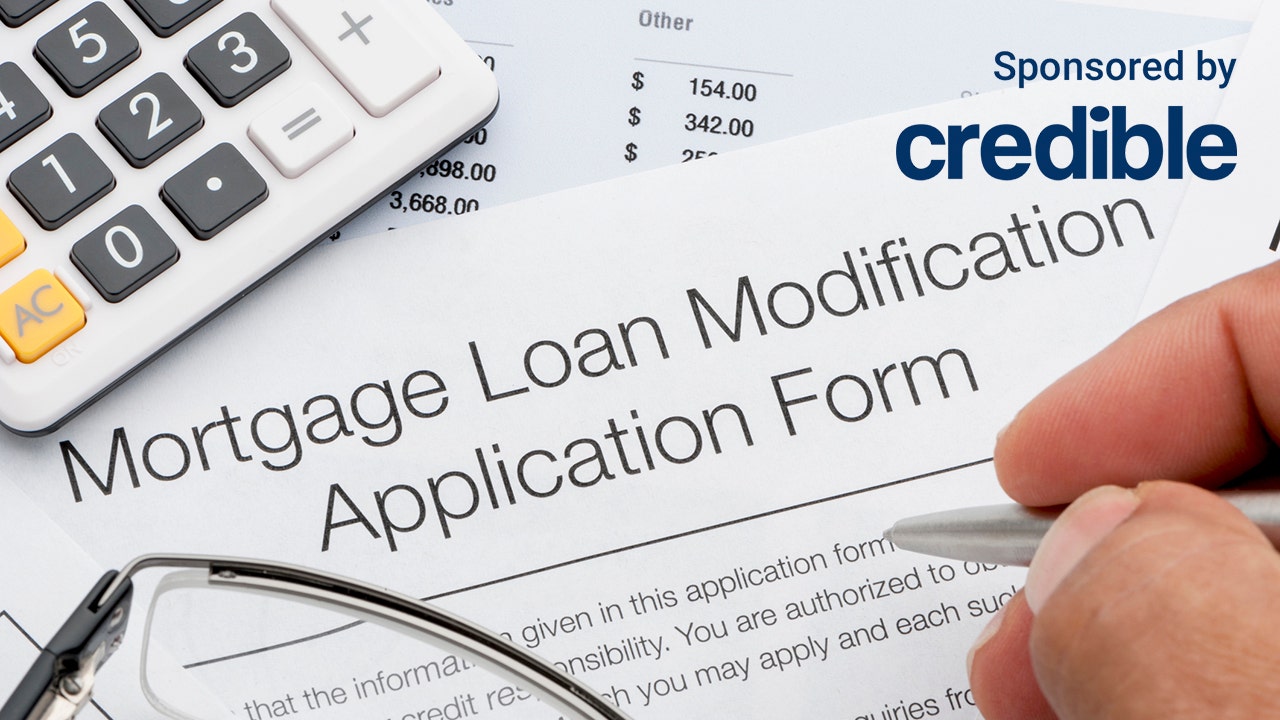

How Does A Mortgage Loan Modification Work Fox Business

How Does A Mortgage Loan Modification Work Fox Business

The Benefits And Drawbacks Of A Loan Modification Realty Warehouse

The Benefits And Drawbacks Of A Loan Modification Realty Warehouse

A Lot Of House Proprietors Meet Their Home Improvement Loans Requirement Of Home Enhancement Through Un Loan Modification Refinance Mortgage Cash Out Refinance

A Lot Of House Proprietors Meet Their Home Improvement Loans Requirement Of Home Enhancement Through Un Loan Modification Refinance Mortgage Cash Out Refinance

![]() The Benefits And Drawbacks Of A Loan Modification Realty Warehouse

The Benefits And Drawbacks Of A Loan Modification Realty Warehouse

Summary Of Pros And Cons Of Both Models Download Table

Summary Of Pros And Cons Of Both Models Download Table

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.